Management tool for chargebacks and other banking backoffice management.

Grupo Diusframi offers its clients a powerful tool based on the most advanced technology, with which to manage chargebacks in an agile and effective way, avoiding tedious processes and costs in terms of time and resources.

DClaims is a software specialized in chargeback management, created by and for experts in the means of payment sector, with updated information adapted to regulatory changes as well as to the needs of each client.

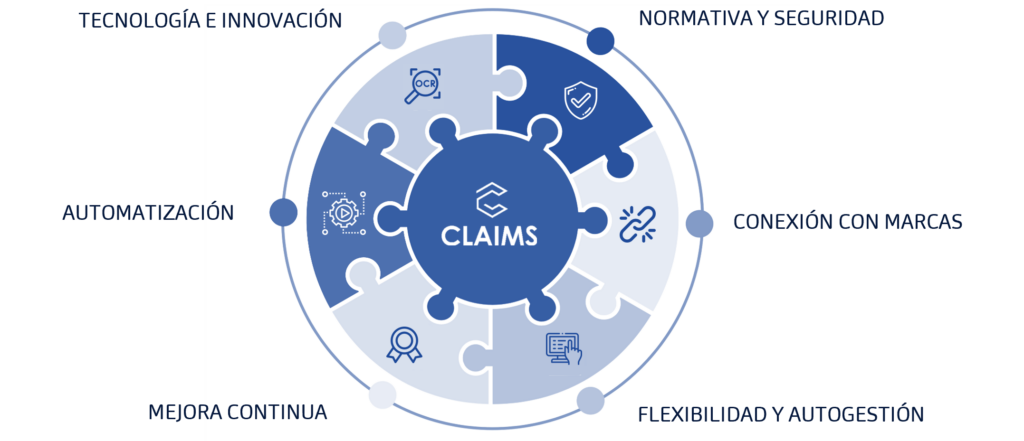

Leverages current technologies, enabling error reduction and improving process consistency: OCR/ICR, ML, BPM, RPA ...and connection with other applications.

Experts in national and international environments. Processes based on compliance with the regulations of VISA, MasterCard, American Express, Multibanco, etc. brands.

We have an expert team specialized in the maintenance of the connections with the brands.

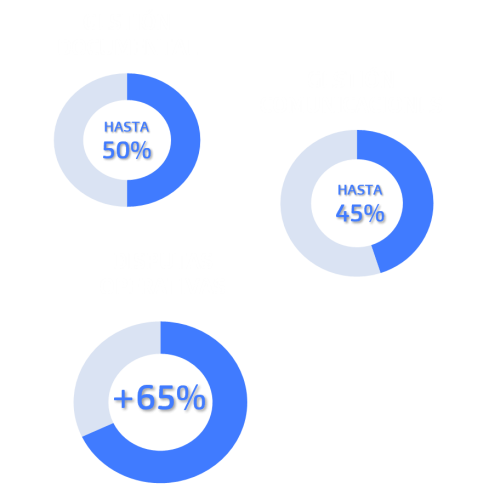

The implemented automatisms allow a substantial reduction of the operational load and therefore of the assigned personnel.

The solution allows easy adaptation to regulatory changes, as well as self-management, monitoring and follow-up by the entity.

Constantly evolving solution led by experts.

Achieving efficiencies at every stage of the dispute lifecycle

Omnichannel access, available self-service and integration with entity, processor and brand systems

Business rules generation and implementation of OCR/ICR image recognition systems technology

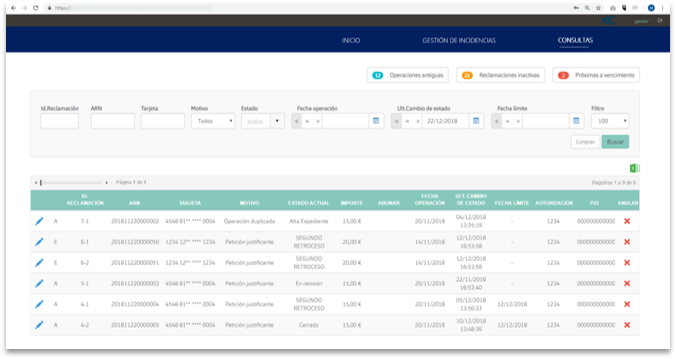

Pre-analysis of transactions for filtering possible reasons for complaint and transaction search filters for file registration

Reduction of file processing times. Incorporates document management, mailbox processing and online monitoring of disputes.

Pre-analysis of transactions for filtering possible reasons for complaint and transaction search filters for file registration

Handling of incidents with expired, blocked and non-existent cards; Documentary management and digital reference in disputes

The guided discharge process minimizes the error rate in the selection of the reason and allows for optimal dispute management.

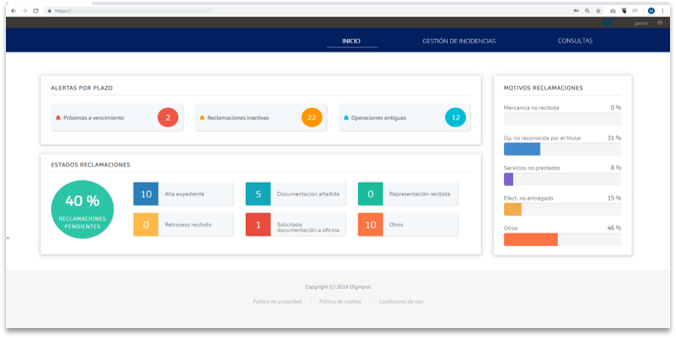

The data provides key information for the dispute management process and can be used to configure rules.

Communication of changes in the dispute or sending deadline alerts and reminders to customers and managers, keeping track of them.

Documentation generated according to regulations and adapted to each reason for complaint, minimizing manual actions and errors.

DCLAIMS has a business rules engine that allows its adaptation to the entity's processes.

For an efficient management of the operational processes, DCLAIMS integrates several communications with the processor

When registering or modifying the claim, the business rules are evaluated and those that meet the marked conditions are automatically executed.

Bulk downloading/embedding of documentation for multiple transactions on a claim streamlines agents' work for disputes

Periodically, the system reviews if there are disputes that meet the conditions to send alerts, customer reminders or periodic communications to external systems.

The integrated management of second actions, through mailboxes, reduces manual management times and centralizes management in a single tool.

Facilitates connection with third-party REST services and allows their configuration. Allows sending or downloading information from third-party systems.

Follow-up reports, according to the client's needs. Indicators by status, reasons and management deadlines.

DCLAIMS is a tool based on the highest levels of security and developed based on compliance with the regulations required by the means of payment industry.

Validation of the authenticity of the formats, through the header magic bytes, in order to avoid malicious file uploads through the interfaces.

Any security incident will trigger our DFIR team, and will be managed. Investigation and generation of full incident lifecycle report and relevant evidence.

Data processing is performed at isolated points of the system, in compliance with regulations.

Thanks to a SIEM we will be able to see a real-time monitoring of events, with notifications and security information, allowing us to identify an attack or threat.

The customer's solution is deployed in an isolated environment with data storage in Europe.

The system is deployed in high availability in Azure, with redundancy of web front ends, APIs and data repositories.

Diusframi Group 2025. All rights reserved.

This website uses cookies to enhance your experience while browsing the website. Of these, cookies that are classified as necessary are stored in your browser as they are essential to the operation of the basic functionalities of the website. We also use third party cookies to help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt out of receiving these cookies. But opting out of some of these cookies may affect your browsing experience.